In an increasingly data-driven investment landscape, UK traders face a crucial challenge: how to tactically position themselves across different equity capitalisation tiers as market cycles evolve. While diversification across sectors or geographies is often discussed, capitalisation-based rotation remains an underappreciated yet powerful approach for investors aiming to capture shifting market leadership.

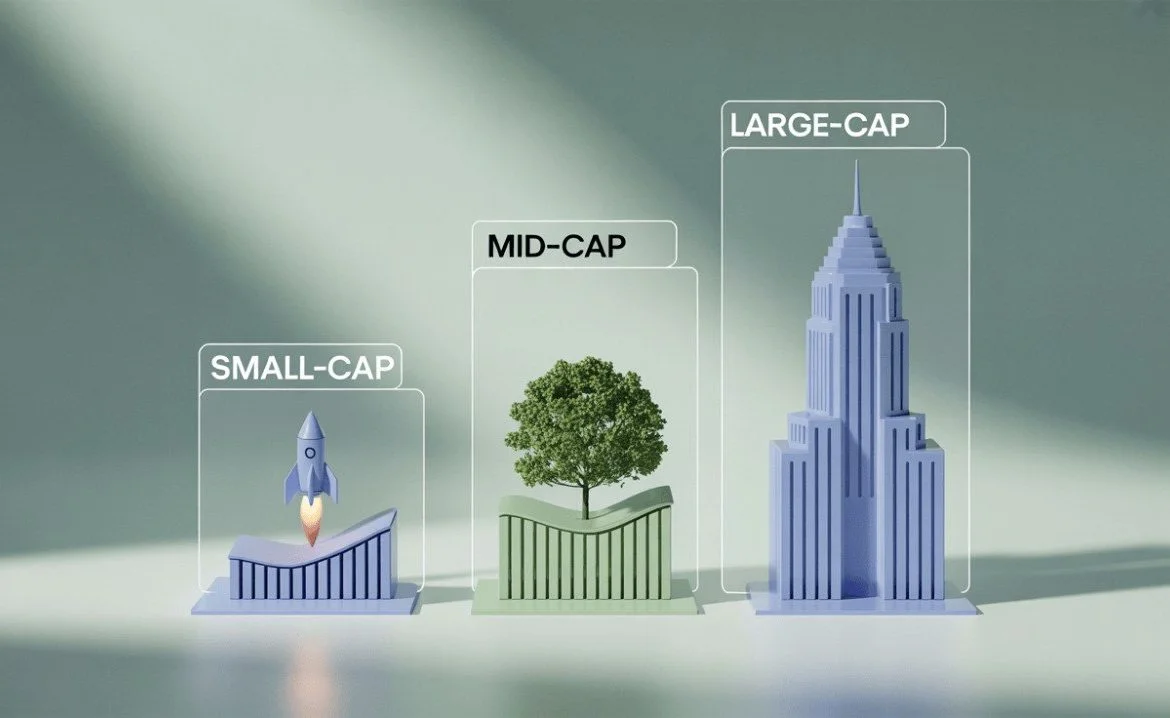

Small-, mid-, and large-cap equities each respond differently to macroeconomic forces, liquidity conditions, and investor sentiment. Understanding these dynamics—and using them to guide tactical allocation—can help traders strengthen resilience and improve return potential.

Leveraging Market Cycles to Guide Capitalisation Rotation

Capitalisation rotation works best when traders align their allocations with key stages in the economic cycle. The logic is grounded in historical performance trends and behavioural finance.

During early economic recoveries, risk appetite tends to surge as investors expect favourable earnings growth and improving corporate conditions. This is when small-caps often outperform. Their leverage to growth means even modest improvements in the economic outlook can translate into sharp upward price movements.

As expansions mature and macro conditions stabilise, mid-caps typically take the lead. Their balance of growth potential and operational scale offers a sweet spot for traders seeking upside without excessive volatility. These companies often excel at scaling during established growth cycles.

Late-cycle phases—characterised by inflationary pressures, tightening monetary conditions, or geopolitical uncertainty—tend to favour large-caps. At this stage, capital flows towards companies with strong balance sheets, diversified revenue streams, and durable market positions. They act as anchors when volatility ticks higher and earnings visibility becomes paramount.

Traders can interpret macro signals—GDP forecasts, PMI readings, yield curve changes, monetary policy announcements, and consumer sentiment shifts—to anticipate when rotations may occur. Monitoring sector-level capital flows and liquidity patterns can further refine timing decisions.

Quantitative Indicators for Capitalisation-Based Trading

While macro awareness lays the foundation, quantitative tools help traders enhance precision. Several indicators and metrics can help identify when rotations are beginning or losing momentum.

- Relative Strength and Ratio Charts: Tracking the performance ratios of small-cap versus large-cap indices, or mid-cap versus large-cap indices, can indicate when market leadership is shifting. When the ratio begins trending upward, it often signals that risk-on sentiment is gaining ground.

- Volatility Measures: Volatility tends to be higher in smaller companies. A spike in volatility across small-caps relative to large-caps may suggest that traders are moving out of riskier assets and reallocating towards defensive positions.

- Earnings Revision Trends: Analysing analyst earnings upgrades and downgrades across capitalisation tiers provides insight into how expectations are evolving. Broad-based upgrades in small-caps, for example, can foreshadow sustained outperformance.

- Liquidity Indicators: Trading volumes often shift ahead of price movements. Mid-caps experiencing sustained volume increases may signal institutional accumulation—a precursor to rotation.

- Factor Models: Growth, value, momentum, and quality factors can behave differently across capitalisation buckets. Understanding where each factor currently sits relative to long-term averages can reveal hidden opportunities.

Using these metrics in combination rather than isolation helps traders build a more robust view of market dynamics.

Tactical Frameworks for UK Equity Rotation

To implement capitalisation-based trading effectively, traders should consider adopting structured frameworks. Below are three approaches commonly used by experienced UK market participants:

Momentum-Based Rotation

This approach prioritises whichever capitalisation group shows the strongest relative momentum. Traders rebalance into the segment outperforming on a rolling basis (e.g., 3–6 months), while reducing exposure to laggards. This works particularly well during trending markets.

Macro-Signal Rotation

Here, traders adjust allocations based on macro indicators such as interest rates, inflation trends, and economic growth forecasts. This approach suits traders who prefer to tie decisions closely to fundamental shifts and market cycles.

Blended Rotation Strategy

A hybrid model combines both momentum and macro signals, providing a balanced structure that adapts to both quantitative cues and economic conditions. This reduces whipsaw risk while capturing structural shifts.

Regardless of the approach, risk management remains essential. Position sizing, stop-loss strategies, and staged entries/exits help traders handle unexpected volatility.

Practical Considerations for UK Traders

Success in capitalisation rotation requires a thoughtful mindset and disciplined execution. Traders should keep the following principles in focus:

- Maintain flexibility: Market leadership changes faster during volatile periods. Adaptability is an asset.

- Avoid overconcentration: Even within capitalisation tiers, diversify across sectors and themes to reduce idiosyncratic risk.

- Stay grounded in data: Use objective indicators to guide decisions rather than relying strictly on sentiment.

- Periodically reassess: Economic conditions evolve; rotation strategies should evolve alongside them.

Combining these considerations with a sound strategy helps traders align with market currents rather than working against them.

Conclusion

Capitalisation-based trading offers UK traders a structured, thoughtful way to navigate market cycles. By understanding the characteristics of small-, mid-, and large-cap equities and recognising how they respond to macro shifts, traders can tactically rotate into the assets best suited for each phase of the cycle.

When combined with quantitative tools and disciplined execution, this approach empowers traders to respond more strategically to volatility and opportunity. Instead of simply reacting to market swings, capitalisation-based frameworks help traders stay ahead of them—positioning their portfolios with greater confidence and clarity.

Whether seeking stability during uncertainty or growth during expansion, capitalisation rotation provides a versatile compass for navigating the evolving UK equity landscape.